Managing payroll is a critical function for any business, but it can also be time-consuming and complex. Many organizations are turning to payroll outsourcing to reduce administrative burden, improve compliance, and free internal teams for strategic tasks.

This article explains why outsource payroll, how payroll outsourcing works, the pros and cons of outsourcing payroll, typical costs, and practical steps for choosing the right provider.

What Is Payroll Outsourcing and How Does Payroll Outsourcing Work?

Payroll outsourcing involves hiring an outsourced payroll provider to manage salary calculations, tax deductions, statutory reporting, and payslip distribution. Here’s how it typically works:

- Data Collection: The provider receives employee details such as hours worked, benefits, and deductions.

- Payroll Processing: Calculates gross-to-net pay and applies tax and social security contributions.

- Compliance Management: Ensures adherence to labor laws and tax regulations.

- Payment & Reporting: Prepares payroll reports and payment instructions for the employer’s bank.

- Support & Updates: Offers compliance updates and human support through cloud-based platforms.

Most payroll outsourcing companies combine software, compliance expertise, and secure systems to deliver accurate payroll on time.

Why Outsource Payroll?

Businesses choose payroll outsourcing for several reasons:

- Reduce Administrative Workload: Free HR and finance teams for strategic projects.

- Improve Compliance: Stay aligned with tax, social security, and labor laws.

- Access Expertise: Leverage specialist knowledge from outsourced payroll providers.

- Scale Easily: Adapt payroll processes as headcount grows without investing in new systems.

- Lower Risk: Minimize payroll errors and late filings.

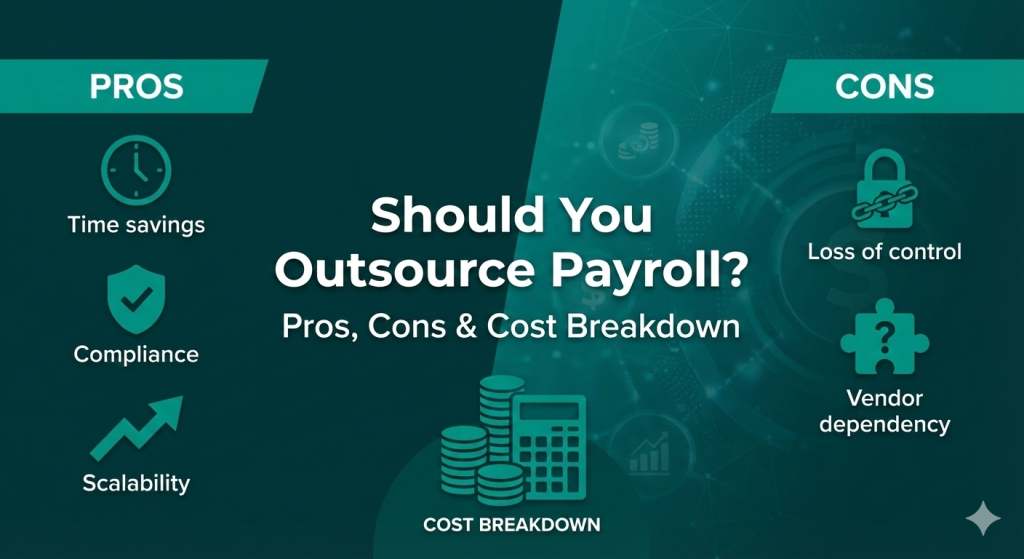

Pros and Cons of Outsourcing Payroll

Pros

- Accuracy & Compliance: Providers maintain up-to-date knowledge of tax and employment laws.

- Time Savings: Internal staff can focus on core business activities.

- Scalability: Easily handle seasonal or rapid growth.

- Data Security: Reputable providers use encrypted systems and strict access controls.

- Cost Predictability: Many payroll outsourcing services cost a fixed monthly fee or per-pay-run pricing.

Cons

- Loss of Direct Control: Response times for ad hoc queries may increase.

- Vendor Dependency: Switching providers can be complex and requires careful planning.

- Service Quality Variation: Not all payroll outsourcing companies in UAE offer the same level of expertise.

- Data Privacy Concerns: Requires strong contractual safeguards and due diligence.

Also Read: Payroll Processing Deadlines: When & How to Submit Payroll

How Much Does It Cost to Outsource Payroll?

Costs vary by provider, region, and service scope. Common pricing components include:

- Setup Fee: One-time charge for system configuration and data migration.

- Per-Pay-Run or Per-Employee Fee: Recurring cost per payroll cycle or employee.

- Monthly Subscription: For cloud-based platforms with service support.

- Optional Fees: Year-end reporting, ad hoc adjustments, and bank payment handling.

Example:

A small company with 20 employees in the UAE may spend AED 1,500–AED 2,800 per month, including WPS compliance and reporting. Larger organizations can negotiate discounted per-employee rates.

When comparing payroll outsourcing companies in UAE, check if pricing includes:

- WPS file submission

- End-of-service calculations

- Leave and attendance integration

- Year-end reports and audits

How to Outsource Payroll: Step-by-Step

- Define Scope: List required services (pay calculations, tax filing, payslips, bank payments).

- Shortlist Providers: Compare outsourced payroll providers and local expertise.

- Evaluate Compliance & Security: Request certifications and encryption details.

- Request Demos & References: Test platforms and speak with existing clients.

- Check Integrations: Ensure compatibility with HR and accounting systems.

- Agree SLA & Onboarding Plan: Define turnaround times and error resolution.

- Run Parallel Payroll: Validate accuracy before going live.

- Go Live & Review: Monitor initial cycles and adjust as needed.

Choosing Between Payroll Outsourcing Companies

When selecting a provider, assess:

- Local Compliance Expertise (especially for UAE regulations).

- Range of Services: Full-service payroll vs. software-only solutions.

- Pricing Transparency: Clear setup and recurring fees.

- Customer Support: Responsiveness and dedicated account management.

- Security Standards: Data protection and residency policies.

Conclusion

Payroll outsourcing offers significant benefits such as time savings, compliance, and predictable costs—but also comes with trade-offs like reduced control and vendor dependency. Businesses should weigh the pros and cons of outsourcing payroll against internal capabilities and budget. A structured selection process and trial runs can ensure a smooth transition to outsourced payroll providers.

How SimplySolved Helps

SimplySolved delivers payroll outsourcing solutions tailored for UAE businesses. Our approach combines secure technology and expert compliance knowledge to ensure accurate payroll processing, timely payments, and full WPS compliance.

Contact us todayto simplify payroll, reduce risks, and focus on growing your business.